Tracing the Journey of the Kind Snack Startup Founder

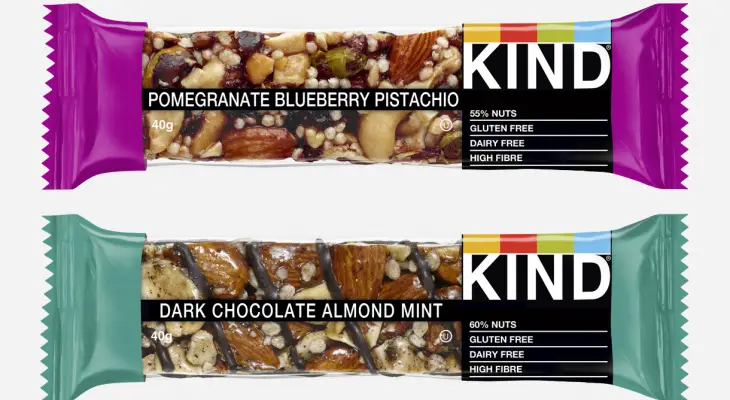

Holiday Ayo - The first time Daniel Lubetzky received significant investment money for Kind Snacks, he made a big mistake. However, now this business actually has a big name in the snack food industry because it is worth USD 5 billion or around IDR 74.4 trillion.

Kind was quite popular in the snack food industry as it was reported to be worth USD 5 billion when it was acquired by food giant Mars in 2020. In 2008, however, the company was much smaller and generated about USD 16 million in revenue from a private equity firm called VMG Partners.

The deal called for Lubetzky to sell the company within five years. At that time, he thought that seemed like a good idea. But four years later, Lubetzky feels he is still the best person to do the job.

So, he makes a gamble that saves him from losing control of his company. As a result he also has a brand worth billions of dollars, he said. He bought back his company shares from VMG.

The nominal is expensive, risky, and time consuming. Lubetzky must raise USD 220 million for the deal. He combined money from company coffers and millions of dollars in bank loans. Any drop in Kind's revenue could cost the company forever.

Negotiations then took two years, culminating in 2014. Kind's annual sales nearly doubled that year. When Lubetzky finally decided to sell the company six years later, it was worth billions, not millions.

In this article, he discusses his decision to buy back Kind stock, why he was willing to take such a big risk and how to overcome his fear of taking back control of his company.

As for his decision to buy back shares, it's like when you climb. Once you reach one peak, you can see even higher, and then you have to climb another, and then you see even higher, he said.

That's what happened to Lubetzky. Four years after the deal, Lubetzky realized that Kind could be much bigger.

Investors pushed him to sell the company and were so excited. However, Lubetzky envisions continuing to grow the company for many years to come.

Leave a comment